Thousands of small businesses are in line to benefit from more efficient payments after GoCardless announced its official launch in Birmingham yesterday.

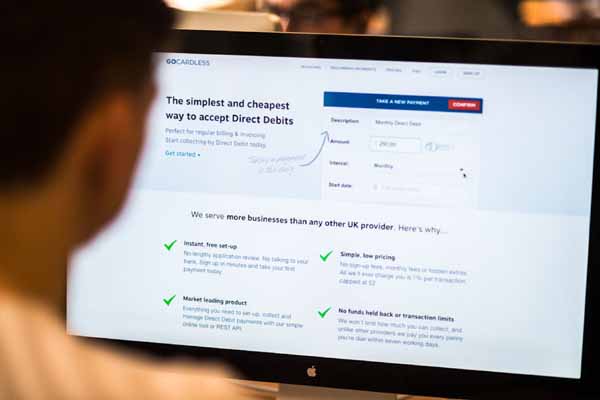

The technology start-up, which was founded by graduates Matt Robinson, Hiroki Takeuchi and Tom Blomfield, has developed a simple online tool that SMEs can use to collect Direct Debits quickly and cost effectively.

Hundreds of companies from ten different sectors in the region are already using the system to process millions of pounds of transactions each month.

Bosses have been impressed with the free sign-up facility, no monthly charges and an innovative pricing structure that charges just 1% of the transaction total to a maximum of £2. This is less than a third of mainstream rivals, such as PayPal and WorldPay.

The introduction of GoCardless could not come at a better time for the local business community, with recent research suggesting that UK SMEs are owed a staggering £36bn in late payments and waste on average 14 days each year chasing them.

“Direct Debits are without doubt the most reliable way to take payments, but the banks have long excluded all but the very largest merchants from accessing the scheme,” explained Matt Robinson.

“Instead, small business owners must attempt to manage unpredictable cash-flows whilst losing key staff to chasing payments, not to mention the possibility of missing out on growth opportunities.

He continued: “GoCardless will give them instant, easy access to a method their larger competitors have been using for years.

“Birmingham is the perfect place to start our regional push and we hope to have thousands of firms signed up and benefitting by the end of the year.”

Any business in the region can sign up online and start taking payments immediately. In two clicks a merchant can ask their customer to set up a Direct Debit to them and, once they agree, future payments are collected automatically. As always, the customer is kept notified but doesn’t need to lift a finger.

The technology has been developed so that GoCardless provides a completely flexible payment solution for one-off payments, subscriptions or variable and irregular payments.

The company is regulated by the FSA, stores data in the UK with military grade security systems and can be integrated into existing accounting software for automatic reconciliation of invoices. The latter includes industry leaders, such as FreeAgent and KashFlow.

Tom Blomfield picked up the story: “Direct Debit can be used by all types of business and that is evident when you look at some of the early users in the West Midlands. We’ve got publishers, independent wholesale retailers, gyms, IT firms, educational organisations and even manufacturers.

“They all share one thing in common…a desire to benefit from more efficient payments.”

GoCardless has grown 50% month-on-month since its launch in 2011. It has recently secured a $5m funding package from UK venture capital funds Accel Partners and Passion Capital to help drive its public rollout in key regional centres and across Europe.

For further information, visit www.gocardless.com, contact 020 7183 8674 or follow @gocardless on twitter.